seans February 5, 2024 No Comment

2024-25 Bellevue & Eastside Real Estate Market Update

The Bellevue and Eastside real estate market has undergone significant transformations in recent years, making it an attractive landscape for investment property development and house flipping. In 2024-25, the market trends indicate that high-end housing remodeling has emerged as the most profitable niche. This article delves into the current state of the economy, interest rate fluctuations, and long-term growth projections, providing a comprehensive overview of the investment opportunities in Bellevue and the Eastside.

Economic Overview

The economic climate in Bellevue and the broader Eastside region remains robust, bolstered by a thriving tech sector, low unemployment rates, and a high standard of living. Companies like Microsoft, Amazon, and Google continue to expand their presence, attracting a highly skilled workforce and driving demand for residential properties. The median household income in Bellevue is significantly higher than the national average, which supports a strong housing market.

Interest Rate Fluctuations

Interest rates have fluctuated over the past year, influenced by Federal Reserve policies to control inflation. In 2023, rates were gradually increased to combat rising inflation, which initially cooled off the housing market. However, by mid-2024, the Federal Reserve began stabilizing rates, providing relief to the real estate sector. Currently, mortgage rates are relatively stable, hovering around 7-8% for a 30-year fixed mortgage. This stability is crucial for investors looking to finance new developments or house-flipping projects, as predictable borrowing costs enable better financial planning. Current projections for the next 1-2 years have rates falling to the 5-6% range.

Investment Property Development

The Bellevue and Eastside real estate market is ripe for investment property development. With an increasing number of tech professionals relocating to the area, there is a sustained demand for rental properties. Investors are capitalizing on this trend by developing multi-family units and mixed-use properties. The high rental yields and low vacancy rates make such investments particularly lucrative.

One notable trend is the rise of sustainable and smart homes. Developers are incorporating eco-friendly materials and energy-efficient systems to cater to the environmentally conscious demographic. These features appeal to renters and add long-term value to the properties, making them attractive investment opportunities.

House Flipping Landscape

House flipping in Bellevue and the Eastside has remained steady, driven by the high demand for renovated homes. Investors are purchasing older properties, undertaking extensive remodels, and selling them at a premium. Focusing on high-end remodels is the key to successful house flipping in this market. Luxury features such as gourmet kitchens, spa-like bathrooms, and advanced home automation systems significantly increase the resale value of homes.

The profit margins in house flipping can be substantial, particularly in upscale neighborhoods where buyers are willing to pay a premium for modern amenities and high-quality finishes. The challenge, however, lies in the initial acquisition cost, as property prices in desirable areas can be steep. Successful flippers often rely on thorough market analysis, strategic purchasing, and efficient project management to maximize returns. However, many property investors fail to adequately understand their costs and rely on projections from Wholesalers—huge don’t do! A wholesaler’s goal is to sell you a property, not to have you make money.

High-End Housing Remodeling: The Path to Profit

High-end housing remodeling has proven to be the most profitable real estate market segment in Bellevue and the Eastside. With the influx of affluent professionals, there is a strong market for luxury homes. Homeowners are willing to invest in significant upgrades to enhance their living spaces and increase property value.

Key remodeling trends include:

1. Open Floor Plans: Creating spacious, open living areas that promote natural light and seamless indoor-outdoor living.

2. Smart Home Technology: Integrating advanced home automation systems for security, lighting, climate control, and entertainment.

3. Luxury Kitchens and Bathrooms: Installing high-end appliances, custom cabinetry, and spa-like bathroom features.

4. Outdoor Living Spaces: Developing outdoor kitchens, fire pits, and landscaped gardens to extend living areas.

These upgrades appeal to buyers and ensure higher returns on investment. In a competitive market, the quality and appeal of remodels can significantly impact top-dollar sales. The first three topics should be the initial focus of every property. Outdoor living space should always be a part of the equation, but in most cases, done to a minimal level; most home buyers want to personalize this space for themselves.

Long-Term Growth and Housing Prices

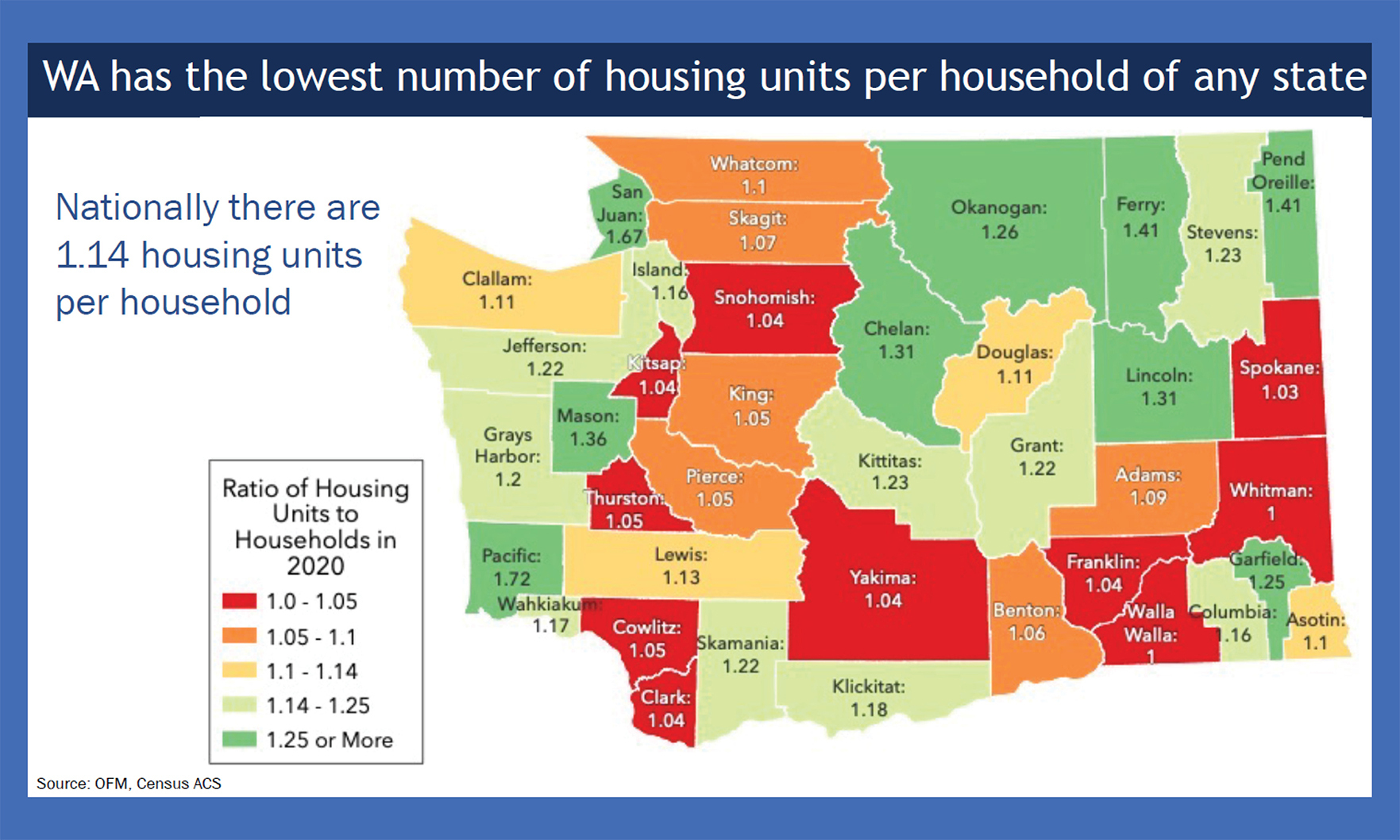

The long-term growth projections for Bellevue and the Eastside are promising. King County anticipates a population increase of 1 million residents over the next 20 years, with a substantial portion settling on the Eastside. This population growth will inevitably drive up demand for housing, exerting upward pressure on home prices.

Several factors contribute to this anticipated growth:

1. Economic Opportunities: Major tech companies and the proliferation of startups attract a steady influx of professionals seeking employment and a high quality of life.

2. Infrastructure Development: Ongoing infrastructure projects, including expanding public transit systems and road networks, enhance the Eastside’s accessibility and appeal.

3. Quality of Life: The Eastside offers excellent schools, abundant green spaces, and a vibrant cultural scene, making it a desirable place to live for families and individuals alike.

Impact on Housing Prices

As demand for housing increases, prices are expected to rise steadily. While this presents challenges for affordability, it also offers significant opportunities for investors. Properties purchased today will likely appreciate substantially over the coming years, providing substantial capital gains.

Investors should consider the following strategies to capitalize on long-term growth:

1. Early Acquisition: Purchasing properties can ensure substantial value appreciation before prices escalate further.

2. Rental Investments: Developing or acquiring rental properties can provide steady income streams and long-term appreciation.

3. Luxury Market Focus: Investing in high-end properties and remodels can yield higher profit margins as demand for luxury homes increases.

The Bellevue and Eastside real estate market in 2024-25 offers a dynamic and promising landscape for investment property development and house flipping. The region’s strong economy, stable interest rates, and anticipated population growth create a favorable environment for real estate investments. High-end housing remodeling stands out as the most profitable niche, driven by the demand for luxury homes and buyers’ willingness to pay a premium for quality upgrades.

As the population grows, the long-term outlook for housing prices is positive, making now an opportune time for investors to enter the market. By focusing on strategic investments and high-quality developments, investors can capitalize on the robust demand and secure substantial returns in the vibrant Bellevue and Eastside real estate markets.

Recent Posts

Categories

- Best Builders

- Brokers for selling and buying homes

- Business

- Caulking

- Construction

- Home Maintenance

- Home Selling

- Interior Home Painting

- Maintenance

- Multiple Listing Service

- National Realtor Association

- New Buildings

- New Home Gym

- New Theater Rooms

- Property Value

- Remodeling Home Work

- Residential Property Values

- WA State Market Trends 2024

- Winterizing your home